Notable Trends

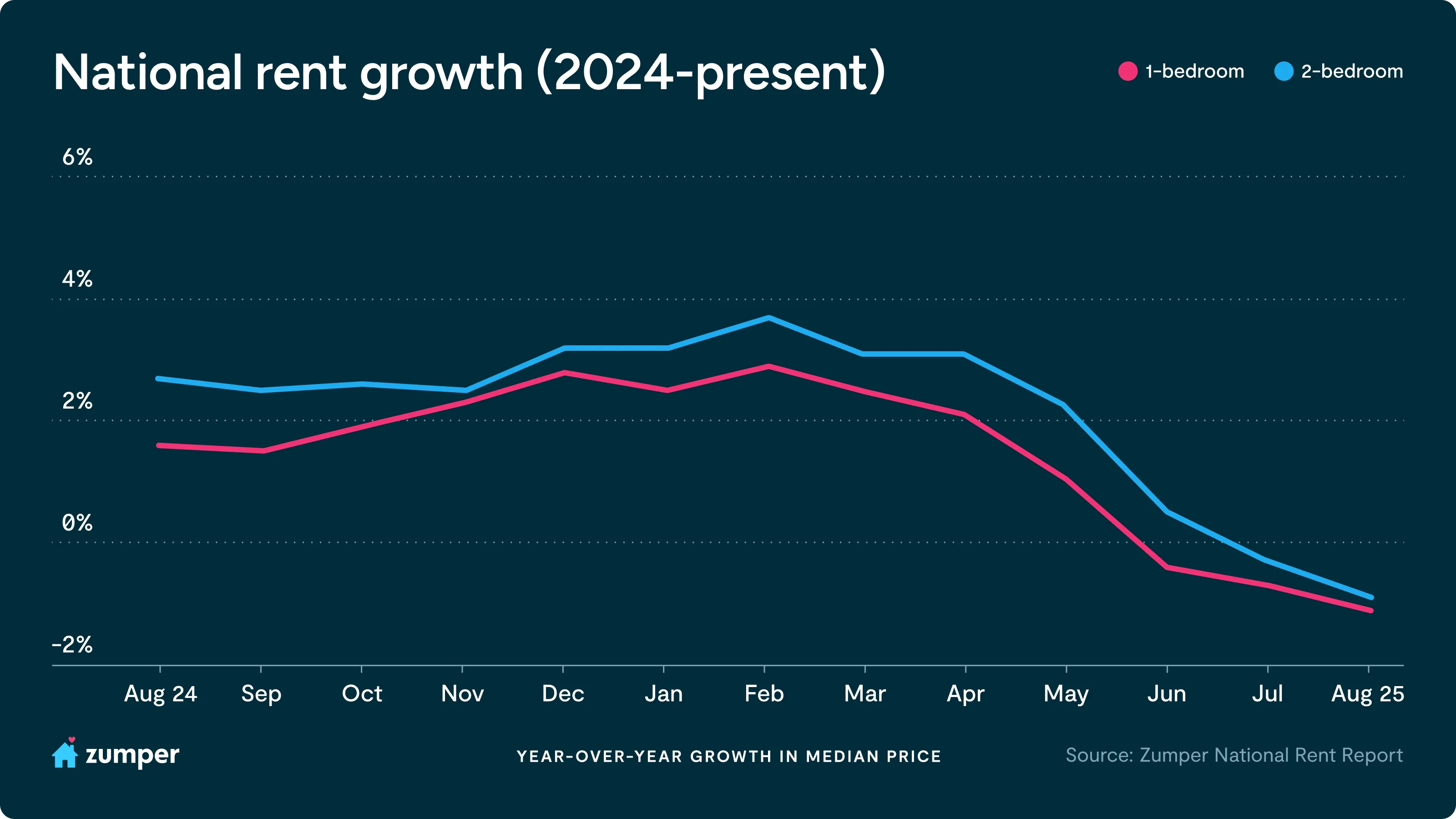

- Zumper’s National Rent Index showed declines across the board for the first time: the median one-bedroom rent decreased 0.2% in August to $1,517, while two-bedrooms dropped 0.4% to $1,897. On an annual basis, one and two-bedroom rents are down 1.1% and 0.9%, respectively.

- August is the fourth consecutive month where annual growth has slowed in the National Rent Index, with rents for both bedroom types now seeing accelerated declines.

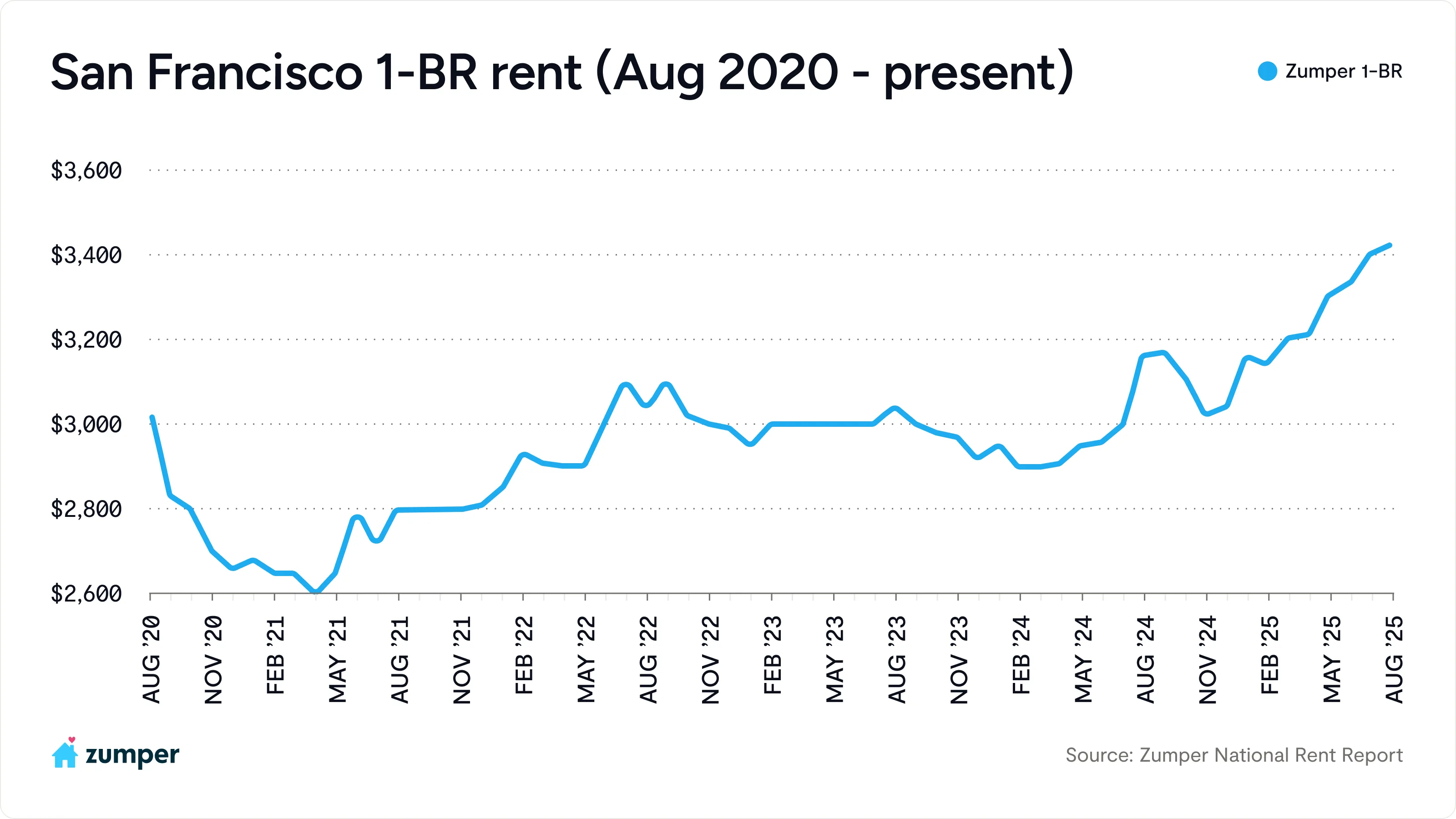

- San Francisco is firmly back in the spotlight as one of the country’s most competitive rental markets with two-bedroom rent leading the nation in rent growth again, up 16.4% annually.

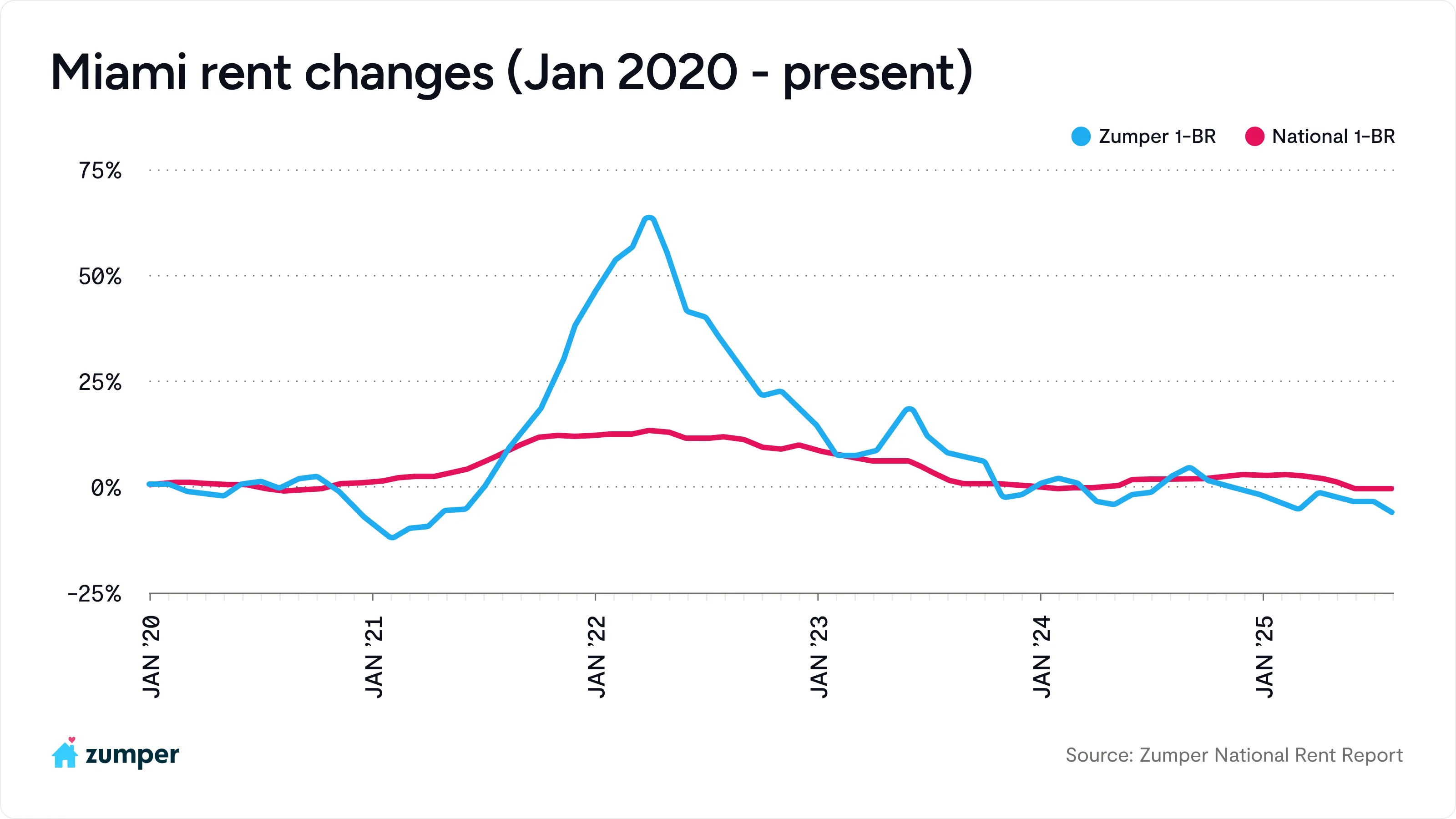

- Miami posted the steepest rent declines among Florida markets in our report, driven by a surge of new supply and a rise in outbound migration.

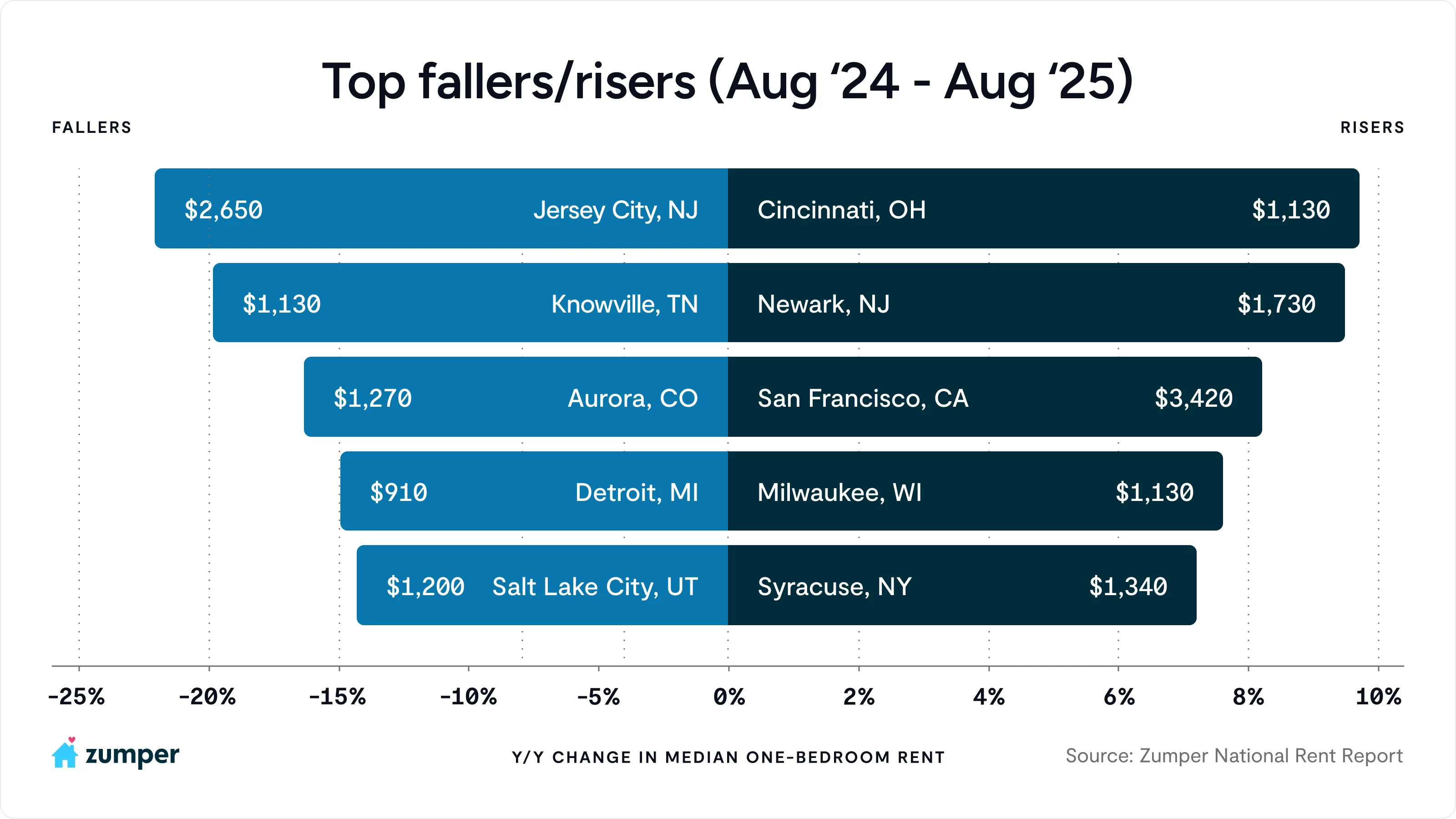

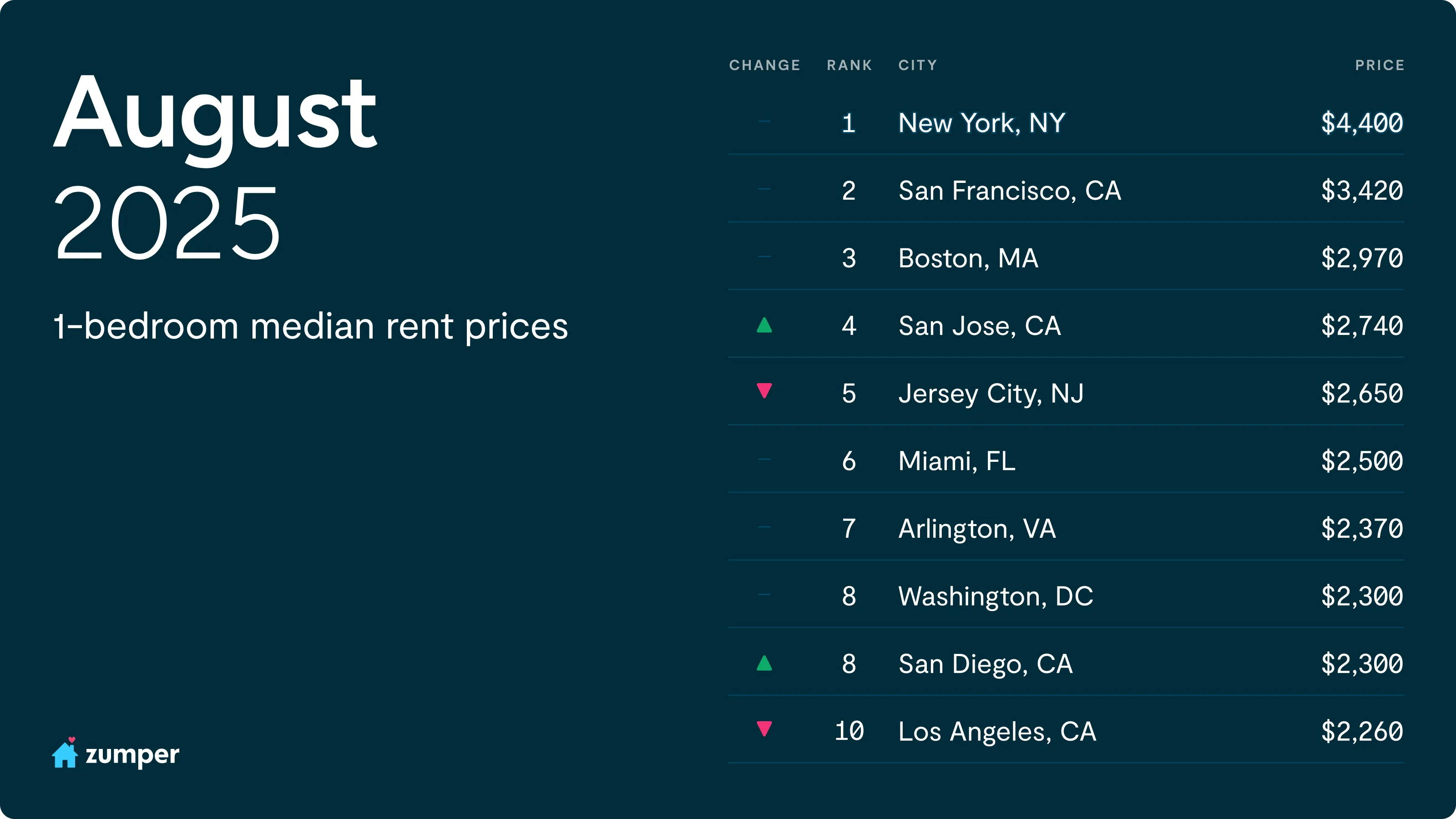

New York City remains the nation’s most expensive rental market, with one-bedroom rent priced at nearly $1,000 more per month than second-place San Francisco. Still, San Francisco continues to see momentum: in August, it posted the fastest annual rent growth among the top 10 markets, with one-bedrooms up 8.2% and two-bedrooms surging 16.4%. In contrast, Jersey City experienced the steepest annual declines nationwide, with rents for both unit types falling more than 20%. The sharp drop also pushed Jersey City down a ranking to 5th, overtaken by San Jose.

National Rent Index sees 4th consecutive month of accelerating annual declines

Zumper’s latest National Rent Index reveals that the median one-bedroom rent decreased 0.2% in August to $1,517, while two-bedrooms dropped 0.4% to $1,897. On an annual basis, one and two-bedroom rents are down 1.1% and 0.9%, respectively. This report marks the first time that the national rent index is negative across the board and the fourth consecutive month where year-over-year growth has slowed, with rents for both bedroom types now seeing accelerated declines.

The U.S. rental market appears to be shifting from stronger than expected demand earlier in 2025 to an unexpected slowdown as we move into the back half of the year. The surge of new supply in the last 12 months has given renters far more options than in previous years. This increased inventory, combined with the “filtering down” effect of new units softening prices in older stock, seems to be pressuring property owners to compete more aggressively on price to fill vacancies.

“This month’s report marks a key turning point. For the first time, our National Rent Index has dipped into negative territory across the board, both monthly and annually, with one and two-bedroom rents now firmly on the decline,” said Anthemos Georgiades, CEO of Zumper. “Renters today have more choices than they’ve seen in years, which applies downward pressure on pricing. Compounding the slowdown is weaker consumer confidence, which affects both sides of the market: renters hesitant to commit in an uncertain economy, and property owners strategically prioritizing occupancy and cash flow over rent growth.”

The most recent CPI data revealed that the rent inflation is up 3.5% since last July, which is slightly below pre-pandemic levels. To dive deeper into how Zumper’s national rent data provides insights to where the CPI is heading, please go to our blog post here: https://www.zumperrentals.com/blog/zumper-consumer-price-index/

San Francisco rents continue to climb

San Francisco rents continue their ascent, with one-bedrooms rising another $20 to $3,420 and two-bedrooms jumping $130 to $4,910. On an annual basis, one-bedroom rent is up 8.2%, while two-bedrooms have surged 16.4%, which was the fastest growth rate for two-bedrooms in the nation. The city’s multifamily vacancy rate has tightened as well, falling to around 5% in Q1 2025 from 6.3% seen in the second half of 2024.

After years of rent declines during the pandemic, demand in the city has rebounded as workers, especially in tech, return to offices and new residents flow back into the city. With limited construction activity and high barriers to building, this renewed demand is meeting a relatively fixed supply, pushing San Francisco firmly back into the spotlight as one of the country’s most competitive rental markets.

Miami leads Florida in rent declines amid wave of new supply and increased outbound migration

Miami was one of the nation’s hottest rental markets during the pandemic, drawing renters in search of more relative affordability, access to outdoor spaces, and a favorable tax environment. The city led the country in annual rent growth in 2022, with prices consistently up over 40% during the spring and summer months of that year. But today, Miami has cooled considerably: one and two-bedroom rents are down 6.5% and 6.7%, respectively, reflecting the largest annual declines in Florida.

This reversal reflects both a wave of new supply and rising outbound migration. In 2024, Florida ranked third in the nation for inventory growth, with Miami among the top markets driving that trend. At the same time, demand has weakened. According to the latest PODS Moving Trends Report, the Miami area ranked third nationwide for move-outs so far in 2025. With more homes on the market and fewer renters competing for them, leverage is shifting firmly back to renters.

Looking ahead, Miami had over 7,000 units permitted in the past 12 months, which is more than any other major U.S. city. If new deliveries continue at this pace and out-migration persists, the downward pressure seen in the city’s rent prices will likely remain in the coming months.