Notable Trends

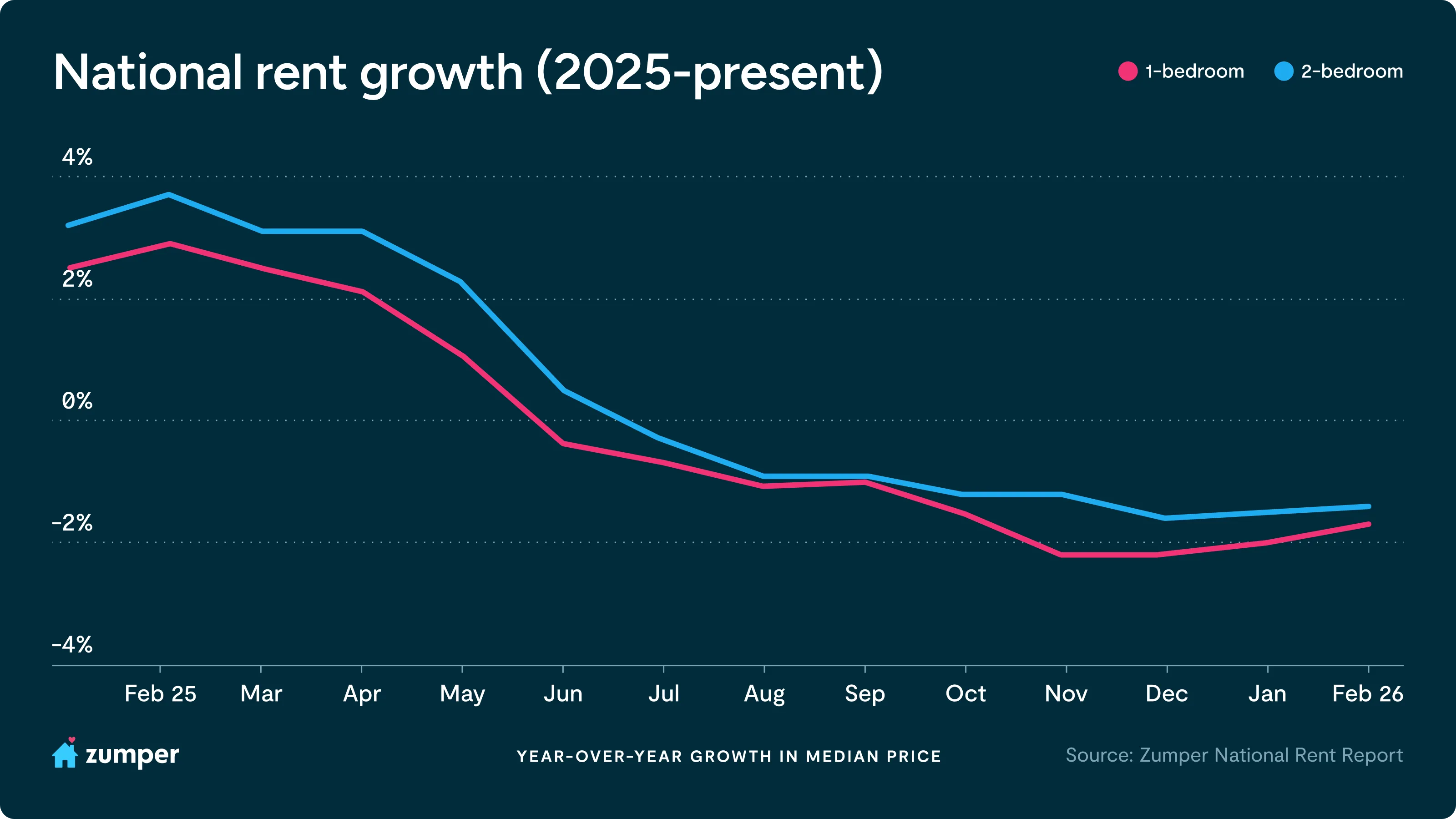

- Zumper’s National Rent Index shows annual rents remain in decline, but the pace of cooling has slowed for a second straight month, suggesting that downward pressure may be easing: the median one-bedroom rent fell 1.7% annually to $1,499, while two-bedroom rent decreased 1.4% to $1,878.

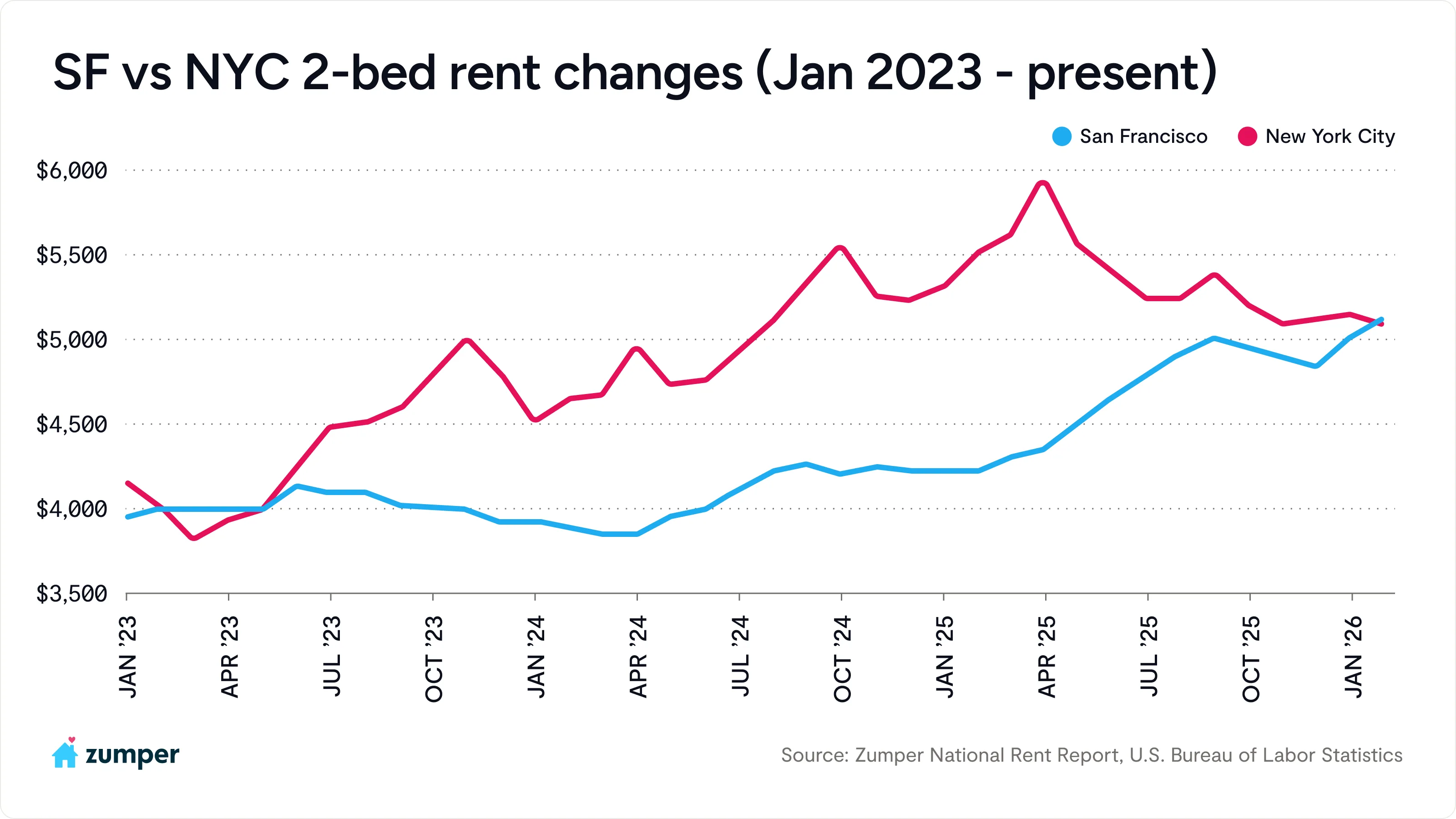

- San Francisco’s two-bedroom rent has overtaken New York City’s for the first time since 2023, now at $5,120, which is $50 higher than New York’s current rate.

- San Francisco also led the nation in annual rent growth, with one-bedroom rent up 15.6% and two-bedrooms up 21.3%.

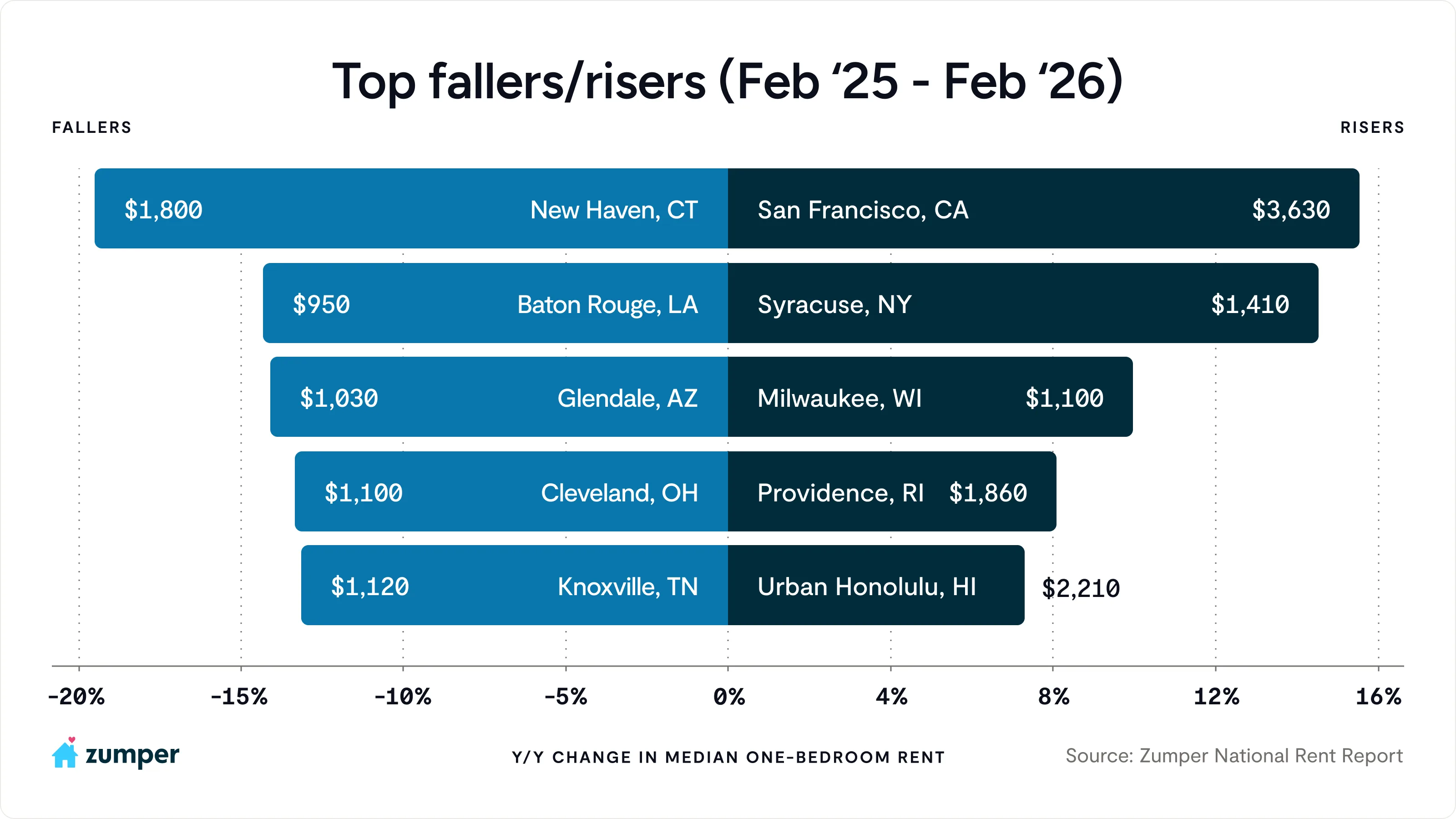

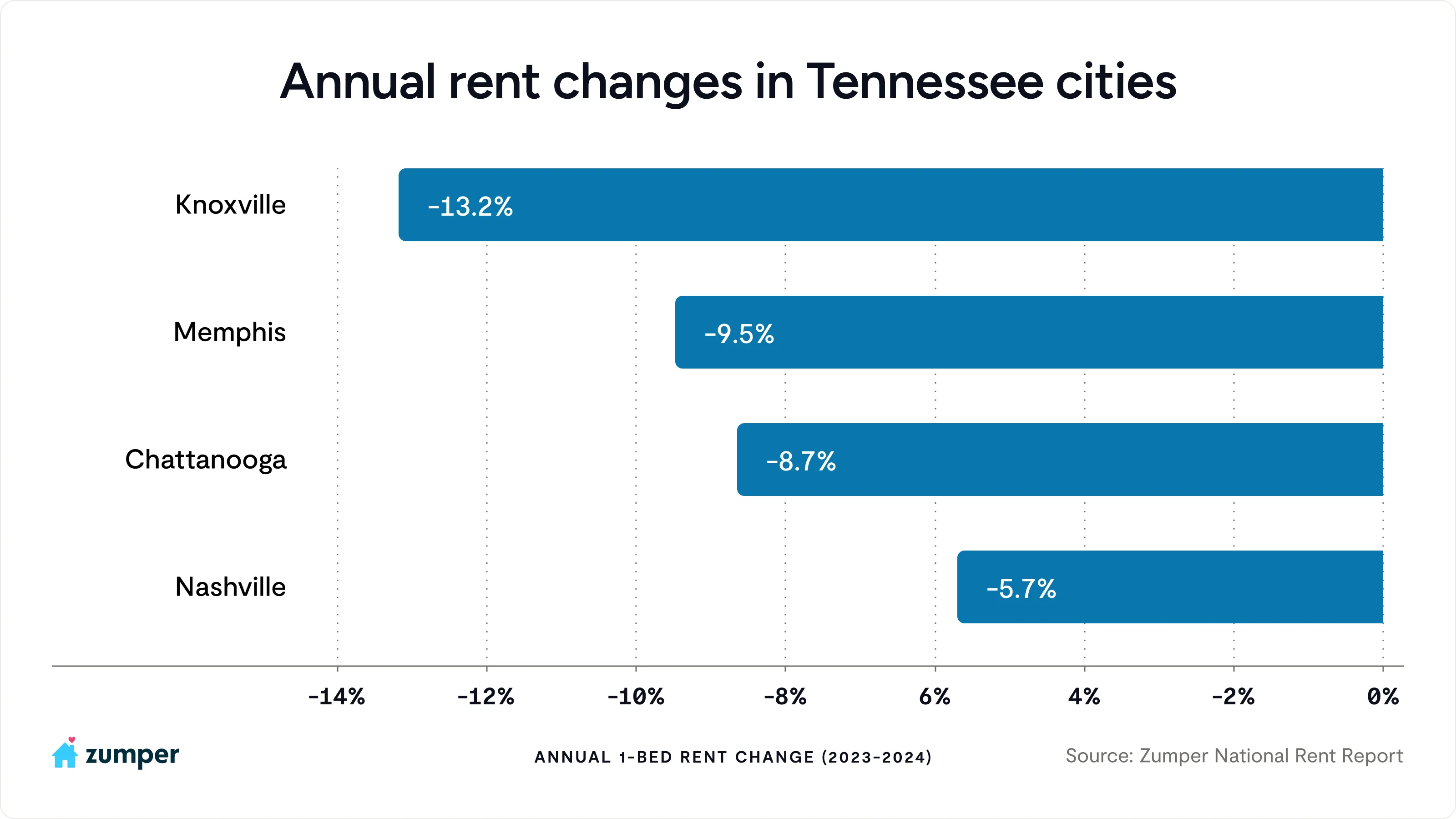

- Rents across all Tennessee markets in our latest report were down across the board, led by Knoxville, where one-bedroom rent fell 13.2% year-over-year.

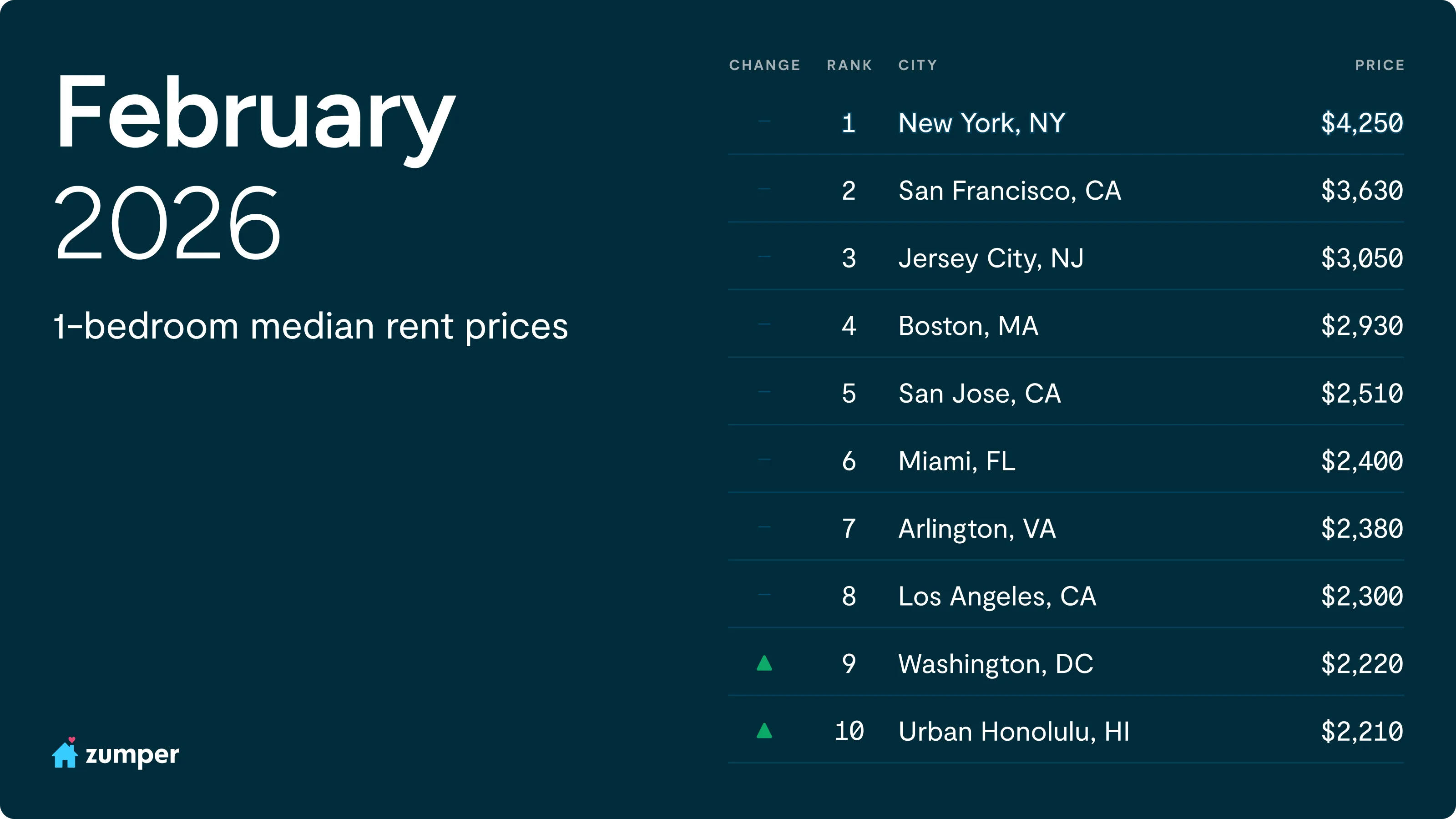

At the top of the rankings, New York City remained the nation’s most expensive market for one-bedroom rents, while San Francisco stood out for growth, posting the fastest annual increase nationwide and ranking as the only top 10 city with double-digit rent growth. Meanwhile, Honolulu entered the top markets this month as the 10th priciest city, while San Diego slipped out.

National rent declines slow, suggesting downward pressure may be easing

Zumper’s National Rent Index reveals that the median one-bedroom rent fell 1.7% annually to $1,499, while two-bedroom rent decreased 1.4% to $1,878. While rents remain lower than a year ago, the pace of declines has slowed for the second consecutive month, signaling that the downward momentum may be easing.

“Our latest national rent data shows early signs that the declines of the last few quarters are moderating as the market begins to rebalance,” said Anthemos Georgiades, CEO of Zumper. “The unusual rent cuts seen last summer and fall appear to have largely run their course, with winter pricing returning to a more typical seasonal pattern. While it’s still early, the consistency in recent data suggests fall 2025 may have marked a cyclical low for many rental markets, especially in supply-heavy Sun Belt and Mountain West regions that are still working through excess inventory.”

Despite early signs of stabilization, rent growth remains constrained by elevated, though gradually moderating, supply. While peak deliveries are now behind us and new inventory in 2026 is expected to normalize, property owners are still competing for renters and a large volume of existing supply still needs to be absorbed, which limits near-term pricing power.

Overall, February’s national data points to a rental market that is stabilizing, though not yet positioned for rapid growth. If these patterns persist into the spring and summer leasing seasons, 2026 is likely to be characterized by a gradual, steady recovery.

Although the Federal Reserve paused further rate cuts this February, inflation has continued to cool. For a deeper look at how Zumper’s national rent data offers an early signal into where the CPI may be headed, read our full analysis: https://www.zumper.com/blog/zumper-consumer-price-index/

SF 2-bed rent surpasses NYC’s for the first time in nearly 3 years

San Francisco led the nation in annual rent growth this February, with one-bedroom rent up 15.6% year-over-year and two-bedrooms climbing 21.3%. That sizable jump has pushed the median two-bedroom rent to $5,120, surpassing New York City’s current rate of $5,070, a notable shift after nearly three years in which New York consistently held the lead. San Francisco last exceeded New York’s two-bedroom rent rate in April 2023, briefly tied in May 2023, and then trailed every month from June 2023 through early 2026.

“San Francisco is a clear example of how quickly rent growth can reaccelerate in supply-constrained markets,” said Anthemos Georgiades, CEO of Zumper. “Renewed job growth tied to AI and a gradual return to in-office work are pushing demand back into the market, particularly for larger units, at a time when new supply remains limited.”

With far less new inventory coming online than in many other markets, renter options are narrowing just as demand for space rebounds, fueling especially intense competition for two-bedroom units often favored by roommates, couples, and higher-income households seeking flexibility.

Rents in Tennessee cities down across the board

Rents across Tennessee markets in our latest report are down across the board, led by Knoxville, where one-bedroom rent fell 13.2% year-over-year. Memphis followed with rent down 9.5%, Chattanooga down 8.7%, and Nashville down 5.7%. The common thread across these markets is a supply-driven reset after several years of rent growth. New apartment deliveries rose, outpacing renter demand. Nashville, for example, delivered more than 8,200 new units annually in the last year, pushing vacancy to a 20-year high by August 2025. With property owners competing more aggressively for renters, pricing pressure has shifted downward.

Looking ahead, construction pipelines are already thinning as Memphis alone is expected to see new inventory fall by more than 58% by the end of the year, which should help stabilize rents over time as excess supply is absorbed. But for now, renters looking for a new home in the area can enjoy concessions that include up to 3 months of free rent, waived fees, and various move-in credits.