Zumper’s rent data provides insights to where the Consumer Price Index (CPI) is heading

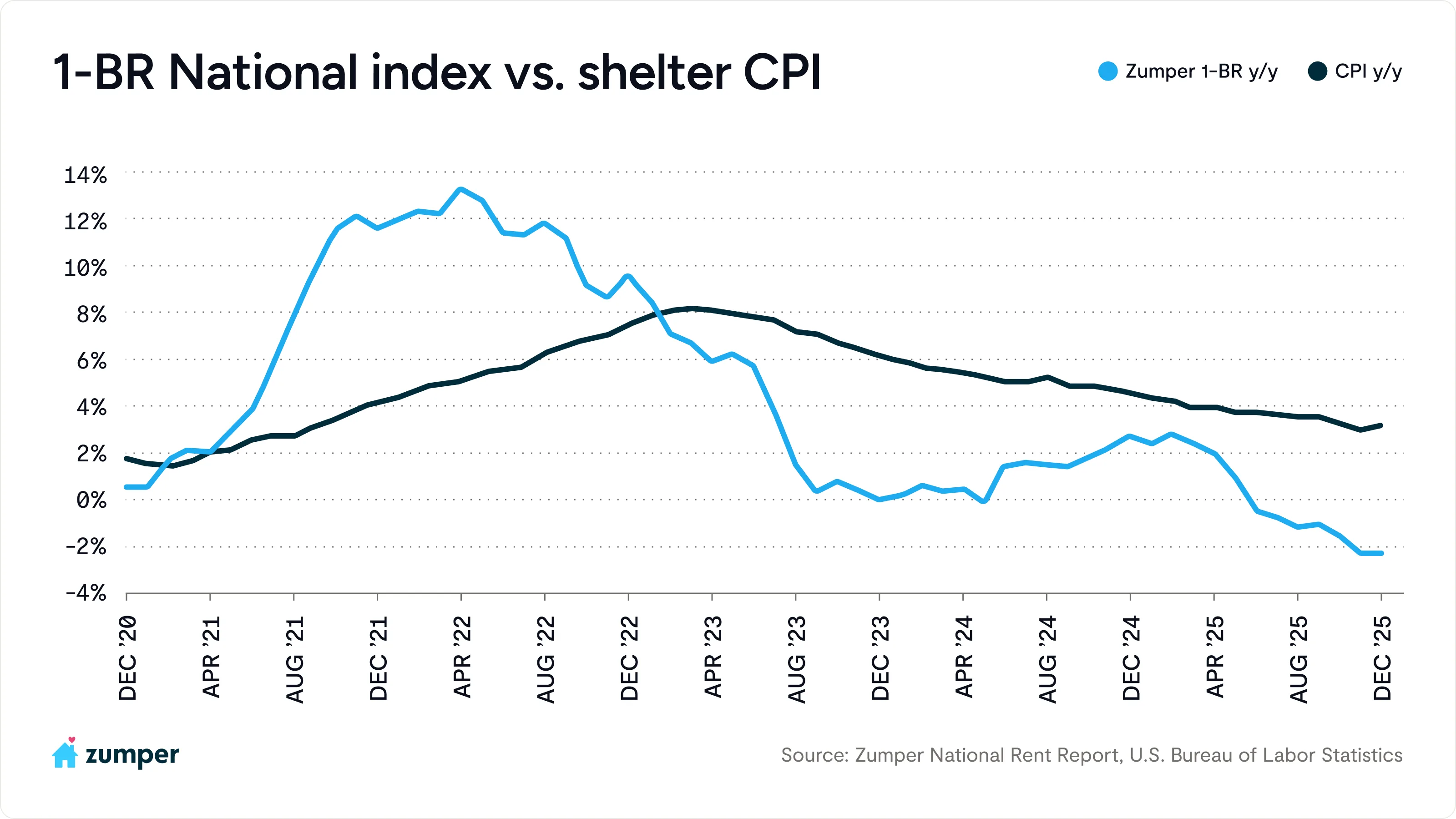

Produced monthly by the The Bureau of Labor Statistics (BLS), the Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for goods and services, including rent. Since the Cost of Shelter CPI uses existing paid rents, among other data points, as part of its calculation, there is a lagging nature to the CPI’s shelter cost component. Zumper’s data, however, serves as a leading indicator of shelter cost as we measure true market rents.

In December 2025, Zumper data showed national one-bedroom rent down 2.2% year-over-year, signaling continued disinflation in housing costs well before those trends are fully reflected in CPI shelter inflation. By contrast, the latest December 2025 CPI data showed shelter inflation still easing, but at a slower pace, highlighting the gap between market-based rent measures and official inflation statistics.

That divergence matters for monetary policy. As CPI shelter continues to catch up to the rent declines already visible in Zumper’s data, it adds downward pressure to headline inflation in the months ahead. This dynamic strengthens the case that the Federal Reserve’s pivot toward rate cuts in 2025 was directionally aligned with underlying housing fundamentals, and suggests that further easing could remain on the table in 2026 as shelter inflation continues to decelerate.