There is a widening divide between Canada’s most expensive rental markets, where affordability ceilings and rising inventory are putting downward pressure on prices, and secondary markets, where demand continues to outpace new supply. High-cost cities are increasingly adjusting downward as renters push back against elevated asking rents, while smaller, more supply-constrained markets are still seeing growth.

Toronto and Halifax offer a clear illustration of this split. The two cities are currently tied for third place, but moving in opposite directions: Toronto slipped from second as one-bedroom rent fell 6.5% year-over-year to $2,150, while Halifax climbed two spots as rents rose 7% annually, reflecting sustained demand and limited new supply.

As 2026 unfolds, markets that can absorb new supply quickly may stabilize sooner, while cities with persistent housing shortages are likely to remain under upward pressure.

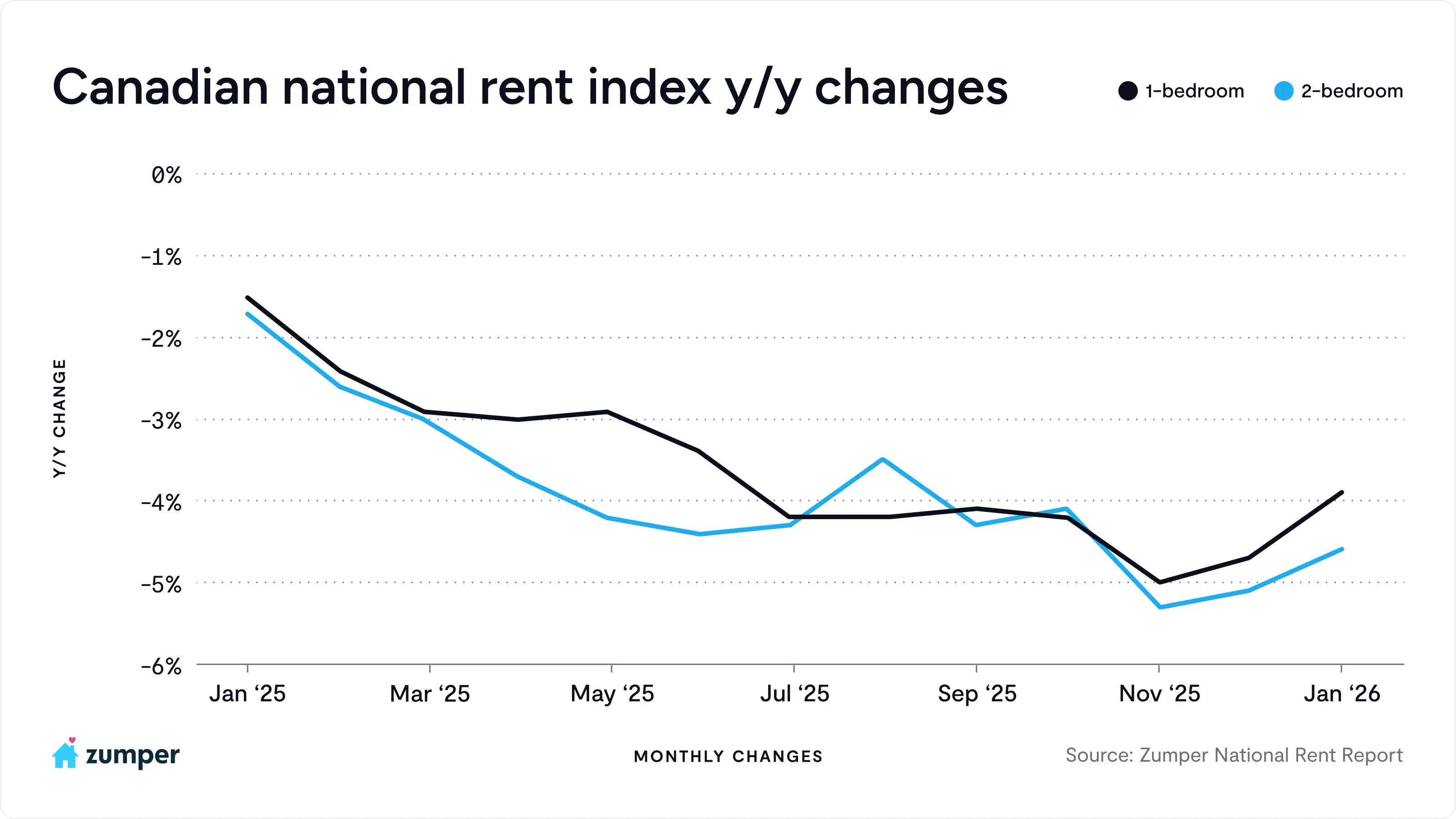

Canada’s national rent index remained negative year-over-year for the 16th consecutive month, with median one-bedroom rent down 3.9% annually to $1,784 and two-bedroom rent falling 4.6% to $2,192. On a month-over-month basis, however, one-bedroom rent edged up 0.5%, while two-bedrooms dipped 0.2%. While the broader trend continues to signal cooling, the modest monthly uptick suggests price declines may be beginning to moderate.

Canada’s 5 Most Expensive Rental Markets

- Vancouver, BC remained the most expensive rental market in Canada, with median one-bedroom rent at $2,420, down 5.1% year-over-year.

2. Burnaby, BC ranked as the second priciest city with one-bedroom rent falling 7.9% annually to $2,210.

3. Toronto, ON dropped down a ranking to third with one-bedroom rent declining 6.5% annually to $2,150.

3. Halifax, NS climbed 2 spots to become tied with Toronto as the third priciest market with median one-bedroom rent at $2,150, up 7% year-over-year.

5. Kingston, ON rounds out the top five with one-bedroom rent at $2,020, marking a sharp 15.4% annual increase.

Biggest Movers: Annual Growth

While national rent growth has cooled, a handful of markets continue to see strong upward pressure:

- Kingston, ON: +15.4%

- Halifax, NS: +7.0%

- Saskatoon, SK: +6.5%

These markets tend to share a common profile: smaller housing pipelines, steady population inflows, and fewer options for renters, allowing rents to climb even as larger markets soften.

Biggest Movers: Annual Declines

Several markets saw sharp annual pullbacks as elevated supply and affordability constraints continue to reset pricing:

- Kelowna, BC: -11.5%

- Barrie, ON: -10.7%

- Burnaby, BC: -7.9%

In these cities, recent construction waves and rent ceilings are translating into meaningful year-over-year declines.

Full Data

| 1 Bedroom | 1 Bedroom | 1 Bedroom | 2 Bedrooms | 2 Bedrooms | 2 Bedrooms | |||

|---|---|---|---|---|---|---|---|---|

| Ranking | Ranking Change | City | Price | M/M% | Y/Y% | Price | M/M% | Y/Y% |

| 1 | 0 | Vancouver, BC | $2,420 | 0.80% | -5.10% | $3,360 | 0.30% | -2.90% |

| 2 | 0 | Burnaby, BC | $2,210 | -1.30% | -7.90% | $2,800 | 0.00% | -6.70% |

| 3 | 2 | Halifax, NS | $2,150 | 2.40% | 7.00% | $2,520 | 2.00% | 5.00% |

| 3 | 0 | Toronto, ON | $2,150 | 0.00% | -6.50% | $2,730 | -0.70% | -9.30% |

| 5 | -1 | Kingston, ON | $2,020 | -4.70% | 15.40% | $2,390 | -4.40% | 22.60% |

| 6 | 0 | Victoria, BC | $1,980 | 1.00% | -2.50% | $2,530 | -1.60% | -6.60% |

| 7 | 0 | Ottawa, ON | $1,880 | -1.10% | -5.50% | $2,400 | -0.40% | 0.00% |

| 8 | 0 | Barrie, ON | $1,750 | -2.20% | -10.70% | $2,000 | 0.00% | -6.10% |

| 8 | 3 | Kitchener, ON | $1,750 | 0.00% | -2.20% | $2,000 | -0.50% | -4.80% |

| 8 | 1 | Montreal, QC | $1,750 | -1.10% | 2.30% | $2,200 | 0.00% | -0.90% |

| 11 | 2 | Oshawa, ON | $1,700 | 1.80% | -5.00% | $2,000 | 0.00% | -7.40% |

| 12 | 0 | Hamilton, ON | $1,690 | -1.70% | 2.40% | $2,000 | 1.00% | 0.00% |

| 12 | -2 | Kelowna, BC | $1,690 | -4.00% | -11.50% | $2,150 | -6.10% | -7.30% |

| 14 | 0 | Calgary, AB | $1,600 | -1.20% | -4.20% | $1,930 | -1.00% | -3.50% |

| 14 | 3 | St.Catharines, ON | $1,600 | 5.30% | -3.00% | $1,850 | -1.10% | -3.60% |

| 16 | 0 | Abbotsford, BC | $1,590 | 0.00% | -3.60% | $1,960 | -2.00% | 0.00% |

| 16 | -1 | London, ON | $1,590 | -0.60% | -7.00% | $1,950 | 0.00% | -5.30% |

| 18 | 1 | Winnipeg, MB | $1,400 | 2.90% | -0.70% | $1,720 | 1.20% | -1.70% |

| 19 | -1 | Windsor, ON | $1,360 | -4.20% | -2.90% | $1,570 | -5.40% | -4.80% |

| 20 | 1 | Quebec, QC | $1,350 | 2.30% | -1.50% | $1,780 | 3.50% | 2.90% |

| 21 | -2 | Saskatoon, SK | $1,310 | -3.70% | 6.50% | $1,600 | 0.00% | 10.30% |

| 22 | 1 | Edmonton, AB | $1,300 | 3.20% | 0.00% | $1,600 | 0.60% | 0.00% |

| 23 | -1 | Regina, SK | $1,260 | -1.60% | 0.80% | $1,450 | 0.00% | 0.70% |

About

The Zumper Canadian Rent Report analyzes rental data from 50k+ active listings across the country. Listings are then aggregated on a monthly basis to calculate median asking rents for the top 23 most populous metro areas, providing a comprehensive view of the current state of the market. The report is based on all data available in the month prior to publication. Any data that is reported does not include short term listings. View our full methodology here.

To keep up to date with the latest rent trends or company news, like or follow Zumper on Facebook, X, and Instagram. In the market for a new place? Search apartments for rent on Zumper.