Becoming a landlord for the first time can feel overwhelming, but it’s also an exciting opportunity to generate steady income and grow your real estate investment. Whether you’re renting out a unit in your home or managing a separate property, following these 10 steps will help you avoid common pitfalls and rent your vacant apartment with confidence.

1. Know your local laws

Before listing your apartment, familiarize yourself with your local landlord-tenant laws. These include:

- Security deposit limits and deadlines for returning them

- Anti-discrimination regulations (Fair Housing Act)

- Required disclosures (e.g., lead paint, mold)

- Rent control or eviction protection ordinances (common in cities like San Francisco, NYC, etc.)

Tip: Check your city or state’s housing authority website or consult with a local property attorney.

2. Set the right rent price

Research similar listings in your area to understand market rates. Consider:

- Square footage

- Amenities (in-unit laundry, parking, etc.)

- Location (walkability, schools, transit)

- Seasonality (demand is often higher in spring/summer)

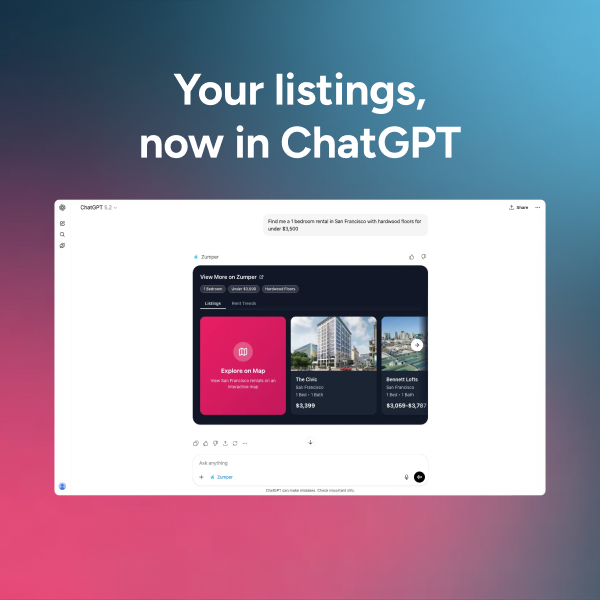

Tools like Zumper, Zillow, or Rentometer can help you benchmark competitive rents.

3. Create a professional listing

Your listing is your first impression. Include:

- High-quality, well-lit photos of each room

- A compelling title (e.g., “Bright 2BR w/ Washer-Dryer & Private Balcony”)

- A detailed description (layout, amenities, policies)

- Monthly rent, required deposits, and application fees

Tip: Stage the unit if it’s vacant. A few furnishings help renters visualize the space.

4. Advertise strategically

List your apartment on multiple platforms:

- Zumper, Zillow, Apartments.com

- Facebook Marketplace and local rental groups

- Craigslist (still relevant in many markets)

Also, place a “For Rent” sign outside if the unit is in a walkable area.

5. Screen tenants thoroughly

Don’t rush this step. Use a rental application and screening service that includes:

- Credit report

- Background check

- Employment verification

- Rental history and references

Zumper’s tenant screening tool is powered by TransUnion and lets you collect this info securely, online.

6. Have a written lease agreement

Always use a written lease—even if renting to friends. Make sure it covers:

- Rent amount and due date

- Lease term and renewal rules

- Maintenance responsibilities

- Late fees, pet policies, and subletting

Tip: Use a lease template that is compliant with your state laws (or consult a local attorney).

7. Collect deposits properly

Most states allow you to collect:

- First month’s rent

- Security deposit (often capped at 1–2 months’ rent)

- Pet deposit (if applicable)

Note: Some states require you to hold security deposits in an interest-bearing account.

8. Document the apartment’s condition

Do a move-in inspection with the tenant and fill out a checklist. Include:

- Photos or video of each room

- Notes about appliances, flooring, and existing wear

Why it matters: Helps avoid disputes when the tenant moves out.

9. Maintain open communication

Be responsive and professional. Set expectations early around:

- How tenants should report maintenance issues

- How long repairs typically take

- How rent should be paid (online, check, auto-pay)

10. Treat it like a business

Keep organized records of:

- Rent payments

- Expenses and receipts

- Lease agreements and correspondence

This will make tax season easier—and help you scale if you buy more properties.

Final thoughts

Being a landlord is a hands-on job—but with the proper preparation, it can be a rewarding one. Stay organized, protect yourself legally, and focus on finding reliable tenants. Over time, your property can become not just an income source, but a long-term asset.