Owning a rental property means you have assets and business risks not covered by traditional homeowners’ insurance, and if you don’t have adequate landlord insurance, you could lose your rental income while your property undergoes renovations after an unexpected loss.

Landlord insurance is available for several types of rental units, including larger properties, quad, triplex, duplex, and single-family. The majority of landlord insurance policies provide some form of the following types of coverage: fair rental income coverage, acts of nature, personal property, flood/water coverage, and dwelling coverage. Also, some insurance companies offer policy add-ons for an additional premium.

How We Picked the Best Landlords Insurance Policies

In determining the best landlord insurance providers, we evaluated the nation’s top insurance companies on their ability to protect landlords against income loss, either from events that would prevent the property from being rented or property damage related to tenants.

In addition to comparing value and policy features, we also considered customer satisfaction ratings. We realize there isn’t a one-size-fits-all rental property insurance solution, so we recommend consulting a qualified agent to help you assess your rental income and increased liability needs to ensure you have adequate coverage.

Choosing the right type of insurance can give you additional security in knowing your rental property and income are safe. Here are a few of the best landlord insurance companies depending on your needs.

Best for Inflation Protection: Liberty Mutual

With an “A” rating from A.M. Best for financial strength, ranked second by J.D. Power & Associates for customer satisfaction, and high marks in processing claims, Liberty Mutual is an excellent landlord insurance plan for inflation protection. Its inflation protection coverage automatically adjusts policy limits to keep up with inflation rates and costs associated with making repairs to your investment property.

Best for Policy Bundling: Allstate

A household name for insurance since 1931, Allstate has received various service accolades, including an “A+ Superior” rating from A.M. Best for financial strength and 4.5 out of 5 stars from an Insure.com customer survey for claims processing. For those who have personal insurance policies with Allstate, bundling a package that includes landlord insurance can expand coverage and at a discounted rate.

Best for Additional Structures Coverage: State Farm

With a longstanding history of customer service excellence and an “A” A.M. Best financial strength rating, State Farm Insurance offers a variety of landlord insurance policies at reasonable rates. Plus, it includes coverage on additional structures, such as retaining walls, fences, swimming pools, storage buildings, and garages.

Best for Multiple States: Foremost

A member of the Farmers Insurance Groups with an “A (Excellent)” rating from A. M. Best, Foremost offers flexible option policies geared towards landlords. Basic landlord insurance options include extended replacement cost and liability, actual cash value, agreed loss settlement, optional replacement cost, named peril coverage, and comprehensive property coverage. Optional coverage selections include water damage for drains and sewers, repair costs, other structures coverage, personal injury, liability limits, and loss of rental income.

Best for Multi-Unit Properties: Farmers

Farmer’s apartment insurance policy offers landlords the unique ability to manage coverage for all their rental units as a single line item. For a landlord collecting rent and addressing tenant needs from multiple buildings or units, any opportunity to simplify monthly accounting has added value.

In addition to the considerable time and effort saved by consolidating landlord insurance policies, Farmer’s provides landlords with the support of a major industry player. Their 18-months of coverage for lost rental income, market-standard coverages, and robust service options protect landlords from building code risks and the increased liability that often comes with owning and managing multiple units.

Best for 10 or More Units: American Modern

With an “A+” rating for financial strength from A.M. Best, American Modern has been an industry leader since 1965, specializing in owner’s insurance for the specialty dwelling and manufactured housing sector. The company offers landlord insurance policies that are tailored to their needs, with options that include:

- Comprehensive Coverage: Insures up to a four-family unit for homes up to 80 years old, 60 for some states. Unless expressly excluded, this policy covers all types of loss. Landlords receive replacement-cost value on losses up to policy limits. Coverage is contingent on the home being in overall above-average or better condition with a roof updated within 20 years of coverage.

- Flexible Coverage: Insures up to a four-family unit on homes of any age. Losses caused by perils named in the policy, including explosion, hail, wind, lightning, and fire are covered. Homes must be considered to be in fair or better condition to be eligible for coverage.

- Coverage for 10 or More Units: Allows real estate investors and landlords to insure 10 or more investment properties on a single policy with the following coverage options: loss of rental income, lawn/shrubs/trees, vandalism, alterations/improvements, mold/water, collapse, fire department service charge, debris removal, damage to other structures, and expenses for emergency repairs. Optional coverage includes limited burglary and breakdown replacement, vandalism, personal property, premises liability, short-term vacancy permission, and short-term rental permission.

Best for Condo Owners: MetLife

While not the only insurance option for rental condos, Metlife is the only major insurer to offer landlords insurance policies specifically tailored to this rental type. For example, MetLife’s loss assessment protection compensates landlords if a condo association votes to charge condo owners, including landlords, and unscheduled assessment fee to cover unplanned repairs. These fees can be significant depending on the work that needs to be done. Assessment protection coverage ensures fees and maintenance decisions beyond your control don’t affect your rental income.

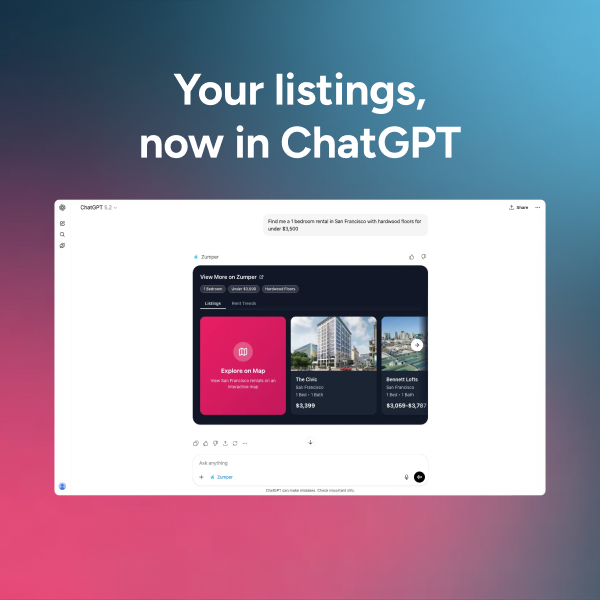

Whether you’re a new landlord or an experienced real estate investor, it’s important to find the best insurer for your needs. If you need help with running your day-to-day operations, Zumper can help you market your listing, screen tenants, and collect rent.