As we look ahead to 2026, multifamily marketers should consider market trends, strategic partners, and scalable solutions that help you drive leases, reduce churn, and prove ROI.

This guide breaks down:

- What market trends predict for 2026

- Emerging trends in renter marketing

- Which KPIs to track

- How to evaluate vendors

- When to start planning

- Where to invest for the highest return

What do multifamily market trends predict for 2026?

Early indicators suggest 2026 will bring modest rent growth, steady occupancy, and re-stabilization in oversupplied markets.

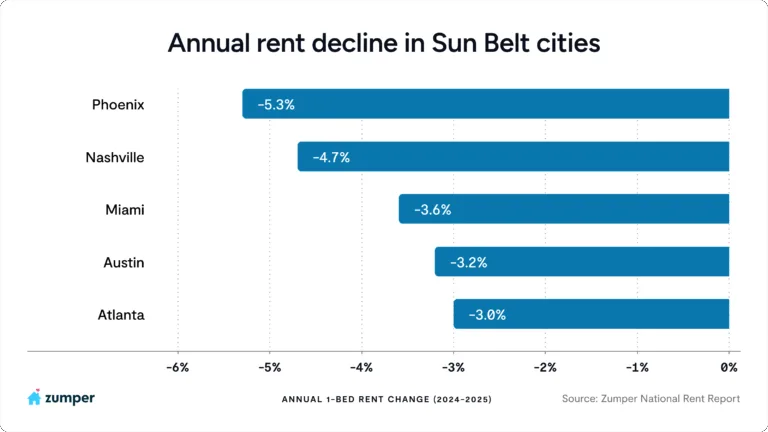

Our June National Rent Report found Sun Belt cities like Phoenix, Austin, and Atlanta continue to see negative rent growth, but declines are slowing. With new construction tapering off, these markets are expected to stabilize as existing supply is absorbed.

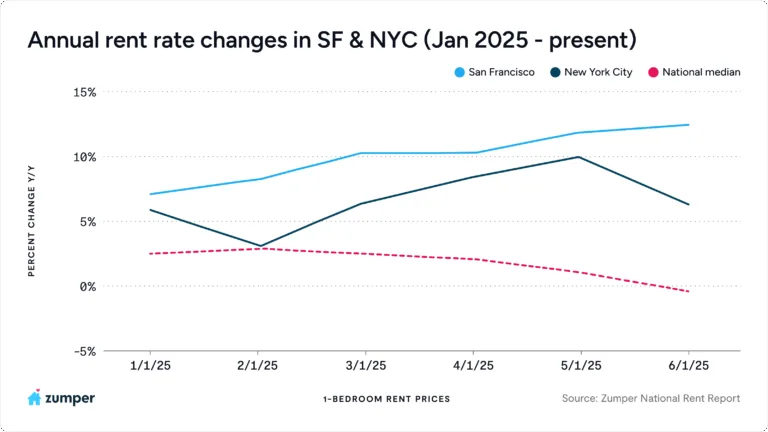

In contrast, urban markets with tight inventory, such as New York and San Francisco, are seeing upward rent pressure. On the West Coast, demand remains strong, but RealPage reporting new supply peaking in 2026 could mean modest rent growth. Meanwhile, cities like San Francisco and Seattle could see softer demand due to declining biotech funding.

In New York, new policies like the FARE Act may shift leasing costs to property owners, with early signs pointing to slight rent declines as the market adjusts, according to our rent report.

Overall, expect moderate rent growth in 2026, with competitive pricing pressures. Property managers should prepare to invest in more strategic marketing solutions and prioritize the renter experience.

What emerging trends are taking shape in renter marketing?

As technology evolves and regulations shift, multifamily marketers must adapt quickly. From the rise of AI-driven search behavior to growing calls for fee transparency and new SEO opportunities on social media, here are three trends that are reshaping how communities attract renters in 2026:

- Answer Engine Optimization (AEO): More renters are turning towards AI chatbots like ChatGPT, Claude, Gemini, and others to find their next home. These platforms pull from search-optimized, authoritative sources to deliver answers, making AEO an essential strategy for online visibility. Optimizing your property website, social media content, and online reputation for AEO can help communities stay competitive and appear where renters are searching.

- Fee Transparency: While there’s no federal mandate (yet), many states are enacting laws requiring rental fees to be disclosed up front, according to CRE Daily. That could mean advertising units with all mandatory fees included, or showing a breakdown of all mandatory and optional fees. Regardless if your communities are in regulated states, transparent pricing is becoming an expectation among renters, not just a compliance issue. Marketers should work closely with their in-house counsel to align on what gets displayed and where.

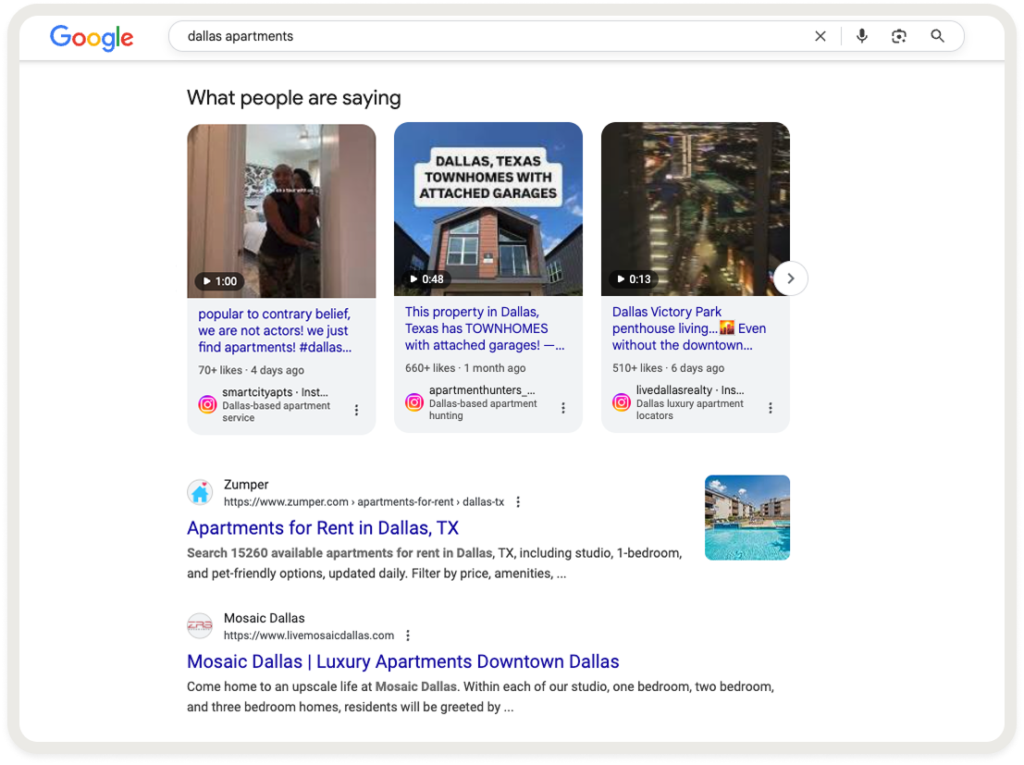

- Instagram Indexing: Instagram recently updated their indexing rules, now allowing search engines like Google and Bing to crawl and surface content from public, professional accounts, as reported by Forbes. That means your Instagram posts, carousels, and reels could show up on Google’s organic search results, including the “What people are saying,” and “Short videos” sections. By simply posting to your Instagram pages consistently, communities have a new opportunity to boost discoverability in competitive markets without buying clicks.

What marketing tactics should property management companies prioritize?

In a market defined by modest rent growth and increased competition, marketing strategies should focus on efficiency, visibility, and retention.

Here are some examples of multifamily marketing tactics:

- Using high-quality media that stands out on listings, Google, and social media.

- Optimizing your Google Business Profile with hours of operation, current availability, and consistent posts.

- Reputation management and review generation to build trust and influence prospective renters.

- Investing in retention tools that improve renewals and drive referrals.

What KPIs should marketers track to evaluate marketing spend effectiveness?

The performance metrics you track depend on what your goals are, like driving more leases, improving engagement online, optimizing for SEO, or improving retention rates.

Here are core KPIs multifamily marketers should consider based on common goals:

- Cost-per-lead (CPL): Measures how much it costs to generate a single lead.

Tip: A low CPL is valuable for volume-focused strategies, but it’s most meaningful when tracked alongside conversion quality. - Organic search traffic: Tracks how many renters are finding your property through unpaid search. An increase here signals effective SEO across listings, your website, and Google Business Profile.

- Online engagement: Includes metrics like social media impressions, post engagement, click-through rates, and website interactions. These indicators reflect brand visibility and top-of-the-funnel renter interest.

- Retention rate: Indicates how many residents renew their leases. Crucial if your goal is to reduce churn and maximize lifetime value.

- Source attribution accuracy: Ensures you understand which marketing channels are delivering results. The renter journey is not a straight line, and often involves discovery across multiple channels and websites. Look for tools that provide clear, reliable attribution across touchpoints.

How to evaluate multifamily marketing vendors

The right partners for your team depends on what you’re trying to achieve: driving more qualified leads, improving brand visibility, boosting retention, or streamlining operations.

Here’s how to evaluate vendors based on your priorities:

- Start with your goals: Look for vendors that specialize in the area you’re focused on, like lead volume, brand awareness, conversion, or retention. Then ask how they measure success.

- Ask for performance data: Review case studies or benchmarks tied to KPIs that matter to you, like cost per lead, lead-to-lease rate, engagement, or resident retention.

- Check for platform or process fit: Choose vendors that integrate with your systems or reduce the need for multiple tools across your portfolio.

- Evaluate support and scalability: A good partner should offer ongoing support and be able to scale with your portfolio as your needs evolve.

- Look for transparency: Prioritize vendors who give you full visibility into results through real-time dashboards or consistent reporting.

When should marketers start planning for their 2026 budget?

While formal budget approvals often happen in Q4, the most effective marketers start planning in late Q2 or early Q3, well before decisions are finalized. Early planning creates more room for testing, analysis, and vendor conversations that lead to better investments.

- More time to evaluate performance: Reviewing what’s working (and what’s not) across current campaigns gives you a clearer picture of where to double down or cut back.

- Flexibility to test new partners or tools: Starting early lets you pilot solutions before fully allocating spend.

- Stronger alignment with leasing goals: Planning earlier gives marketers time to collaborate with operations, leasing teams, and leadership, giving you a more strategic, goal-aligned budget.

Where to invest for the highest return in 2026

With 2026 expected to bring modest rent growth and increased competition, the most successful marketing budgets will prioritize high-impact, renter-facing strategies that drive both visibility and retention.

- Listing marketplaces: Nearly 75% of renters visit an ILS during their search (according to a survey by NMHC and Grace Hill), making it a critical channel for visibility. Structured listings also help properties surface in emerging platforms like AI-powered search. And as fee transparency laws evolve, ILS platforms play a key role in helping communities clearly display required pricing to meet renter expectations and regulatory standards.

- Rich media: Optimize your listings and property website with high-quality media like editorial photography, virtual staging, and 3D tours. A RentCafe study of 10K respondents found 73% of renters felt interior photos were the most influential in their leasing decisions. Meanwhile, 45% considered virtual and 3D tours as “very important.”

- Google visibility: Your Google Business Profile is a critical first impression. Invest in claiming, updating, and posting consistently to improve SEO and increase conversion-ready traffic.

- Online reputation & review generation: Renters rely on reviews. In fact, a study by SatisFacts found 75% of renters check out a community’s online reviews before making contact, and 64% say online reviews were a contributing factor in their decision. Solutions like Amplify Reviews help you generate new, authentic reviews while identifying and removing harmful, illegitimate ones.

- Social content and brand awareness: Social media channels are emerging as SEO-friendly discovery tools. With Instagram content now indexable by Google, your content can drive organic visibility on search engines. Content creation and posting solutions like Amplify Social help you stay active and on-brand across platforms, without requiring in-house bandwidth.

- Resident experience & retention tools: With occupancy stabilizing and rent growth softening, keeping current residents is more cost-effective than finding new ones. Invest in social proof tech that supports renewals and referrals through peer connection.

Final Takeaway

As we head into 2026, multifamily marketers face a market defined by modest rent growth, stabilizing occupancy, and increased competition. New technologies and considerations, like natural language search engines, fee transparency laws, and evolving organic marketing channels, are reshaping how renters find and evaluate communities. Success will come from early planning, goal-driven vendor selection, and smart investments in visibility, engagement, and retention. The strongest budgets will align marketing spend with performance, and prioritize strategies that make your communities easier to find, easier to trust, and harder to leave.