Renting your house gives you additional income and helps you qualify for tax deductions. Property increases in value over time, and renting out your house helps build up long-term equity. It’s no wonder so many Americans choose to own rental properties. Do you need a license to be a landlord? In short, yes. Let’s dive in and put some context behind it.

How to Acquire a Renters License

If you’re planning to start renting out your home, the need to have rental licenses varies from state to state. Renting without a rental license is illegal, so make sure you check with your state laws and regulations. Operating without one denies you the legal right to collect rent and, if caught without a permit, you will incur fines. For long-term penalties, you risk the possibility of being denied rental licenses in the future.

Making your property compliant is simple. The rental license application process is straightforward, with clearly outlined steps for your convenience.

Steps for acquiring a rental license:

- Fill out the application form: You can access the form from your state’s housing website or at the city hall. You may be required to pay a small application fee. Once the form is completed and submitted, you are free to start the subsequent processes.

- Inspect your rental units: Inspection serves the primary purpose of ensuring your house is livable and meets all the safety standards. The electrical and plumbing systems should also be in perfect working condition. Some rental licenses necessitate that your properties undergo inspection after a certain period.

- Make adjustments to your properties: Once the inspection has been carried out, improve your house’s status on areas below par. Hire professional constructors to make the necessary renovations to code. Receive your license after achieving compliance.

Business License

The decision on whether to have a business license for your rental property lies with your respective state. You can acquire a business license when you create an LLC for your rental units. Forming an LLC reduces your liability risk and separates your assets.

Another advantage of registering as a business, you can pass the business income through the company to the respective LLC members. This allows the LLC members to report their share of profits or losses in their individual tax returns.

Additional Requirements to Rent your House

Acquiring rental and business licenses is the first step of getting started in the rental industry. There are more things you need to get sorted as a landlord, such as Landlord-Renter law:

1. Landlord-Renter Law

This law defines the rights that a landlord and renters have within the rental property. Like all the other regulations, these laws differ by state. Inquire what is stated in the laws of your city or state. Give new renters a summary of the landlord-renter law to avert any future problems.

The laws also describe how you should advertise your property. It also covers the following areas: property access, security deposits, a minimum notice period of ending a lease, etc. You should be wary of federal laws also that focus on housing safety and prohibits discrimination.

2. Landlord Insurance

Covering your property with insurance helps you withstand future problems. The landlord insurance covers you for incidents that result in loss of your rental income and theft or damage to your property. Landlord insurance also targets and protects your renters or people on your property. Signing up for landlord insurance will save you money and legal headaches in the future.

3. Lease Agreement

A lease is a legal document that outlines your agreement and ensures both parties are comfortable with the plans. If you draft a lease that violates some of the laws, it can be declared null and void in a court. While preparing a lease agreement, be sure to include policies that are specific to what you want. For example, you should clarify your stance on pets, the process of breaking the lease, etc.

4. Security Deposit

The security deposit is often equal to one month’s rent and is usually refunded fully or partially at the end of the lease term. The security deposit protects you as a landlord, ensuring that rent is paid and no damage is accrued. Some states demand you put the security deposit in a different account to ensure it is safe, but it is also wise to do so as a landlord if there are no such regulations.

5. Rental Price

Setting the right price that suits both parties is essential. Consider expenses such as property taxes, utilities, repairs, and the monthly profit you will be receiving. Furnished houses have a higher rental price than regular houses. Also, countercheck with prices of other housing units in the neighborhood to determine whether your rates are competitive.

6. Screening the Renter

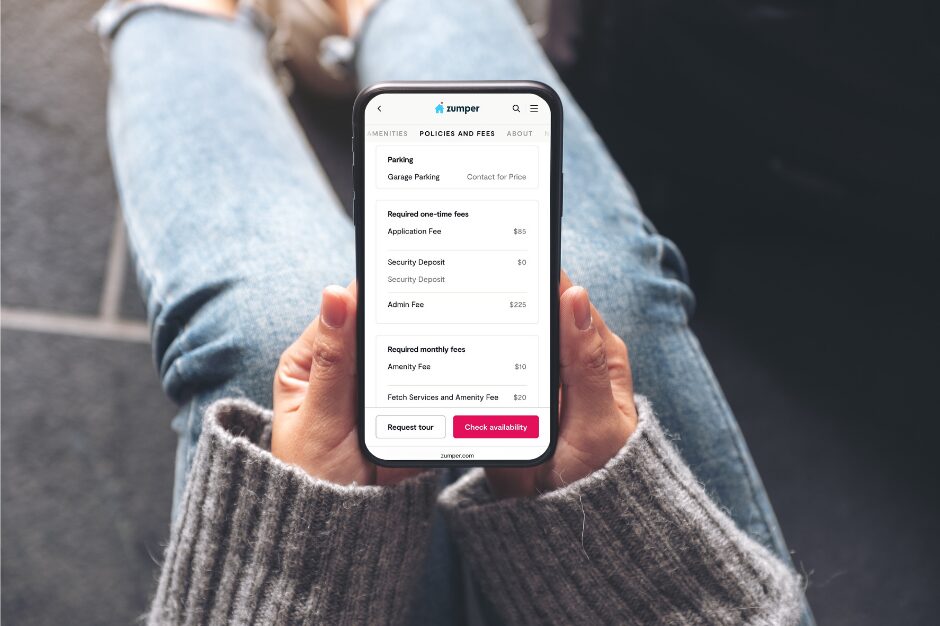

Every landlord wishes to find a suitable renter who looks after their property well as if it was theirs. Landlords prefer renters who will rent for an extended period, and to ensure this, you may prepare a 12-month lease or more. To determine serious renters, you may ask them to fill out an application form and pay application fees if need be. Don’t want to do it all yourself? Zumper offers a free screening tool to help ensure you find the right renters.

If you are thinking of renting out your house, you must first require a rental license. Once you meet all the requirements, you need to list your property on the market. Post your listing for free on Zumper and find the right renter for your home.