What does it take to be a landlord? That question is likely at the top of your mind if you’re interested in generating wealth through an investment property or renting out a property you already own. Learn to be a landlord by following these key tips.

Buy a Rental Property

Any “landlord for dummies” guide will include buying a property to rent right at the top of the list of things you need to do to get started with becoming a landlord. Before you buy an investment property, or even start renting out a property you own already, you should make sure that property can produce a positive cash flow.

Landlords can own a variety of building types, from condos and multi-unit properties to single-family houses. The type of building you buy will impact the amount of money you will need to finance and budget for repairs and will also play into the potential for profit. Keep in mind, though, that the larger your property is, the more labor- and cost-intensive it can become.

Ideal rental properties tend to share certain characteristics, including:

- The property is already in good condition (so you won’t need to immediately put money into big repairs).

- The property has a potentially high return on investment.

- The property is within your budget.

New landlords also find it helpful to invest in a property close to home. Living close to your rental property will save you on transportation costs. The proximity will also come in handy when you are showing the rental property to potential renters, taking care of any needed repairs, and stopping by periodically to check on your property.

You will also want to make sure the property offers renters an attractive place to live. Factors renters look for include:

- Walkable neighborhoods

- Safe communities

- Easy commutes

If your investment property checks these boxes, you may have an easier time finding renters for the space.

Figure Out What You’ll Charge for Rent

If you want to be a landlord, you will have to determine the right amount to charge for rent. You will want to find the sweet spot between setting rent too low (which will cut into your potential profits) and setting rent too high (which will push away potential renters). Figure out a good amount of rent to collect by checking how much similar rentals in your area cost. Then, factor in utilities and a budget for repairs. You’ll also need to stay aware of changes in market conditions so you can increase the rent when needed.

Understand the Costs

It’s easy to understand the costs associated with becoming a renter — things like monthly rent and security deposits are fairly common. However, becoming a landlord also comes with costs you will need to budget for in order to succeed. Expenses to think about include:

- The mortgage for your property

- Depreciation and tax deductions

- Fees and salaries for subcontractors and employees as well as legal expenses

- Insurance

- Utilities (even if renters pay for utilities, you’ll need to cover these costs when a unit is empty)

- Advertising

- Minor repairs, such as paint or air filters

- Major repairs, like a new HVAC system or a new roof

Although big repair expenses won’t happen all the time, at some point you will need to replace something expensive and should be prepared for when that happens. You may also need to deal with missed rental payments and other surprise expenses.

Buy Landlord Insurance

Purchasing landlord insurance is an important part of becoming a landlord. This insurance will protect your property from sudden loss and accidents. It will also protect you (and your financial assets) if there is a liability claim.

Landlord insurance usually covers:

- The property’s structure

- Medical expenses associated with the property

- Legal costs associated with the property

- Loss of rental income if you need to make necessary repairs

Landlords typically are not responsible for the renters’ belongings. You should encourage renters to buy renters insurance to cover their belongings.

First-time landlords should check with their insurance agency to determine the type of coverage needed for the property. In most cases, you’ll have different coverage requirements than if you lived on that property.

Become Familiar With Landlord-Tenant Laws

Learning how to be a landlord includes learning about landlord-tenant laws. This includes both federal and state or even local regulations.

Federal laws relate to habitability and anti-discrimination. For example, landlords cannot discriminate against potential renters based on race, national origin, disability, sex, and more.

Most states also have legal provisions that govern the landlord-tenant relationship. These laws can deal with issues like giving notice to renters before you want them to vacate the property, level of access to the property, and security deposits.

Find (Reliable) Renters

Before jumping into signing a lease, you should properly screen prospective renters to make sure you’re getting reliable people to live in your rental apartment or house. Collect applications and run background and credit checks on all prospective renters over the age of 18, making sure you’re complying with all applicable fair housing laws.

Your rental application should give you information about a potential renter’s history and background, such as:

- Personal information (such as name, email address, and phone number)

- Current and previous residences

- Employment and income

- Household information, including additional occupants and/or pets

- Prior bankruptcies and/or evictions

Since many renters choose to live with other people, you’ll likely need to review and screen multiple renters for the property. Once you’ve found reliable renters, it’s time to sign your them to a lease agreement! Make sure that the lease sets rules and expectations both for you and your renter, again ensuring the agreement complies with all applicable laws.

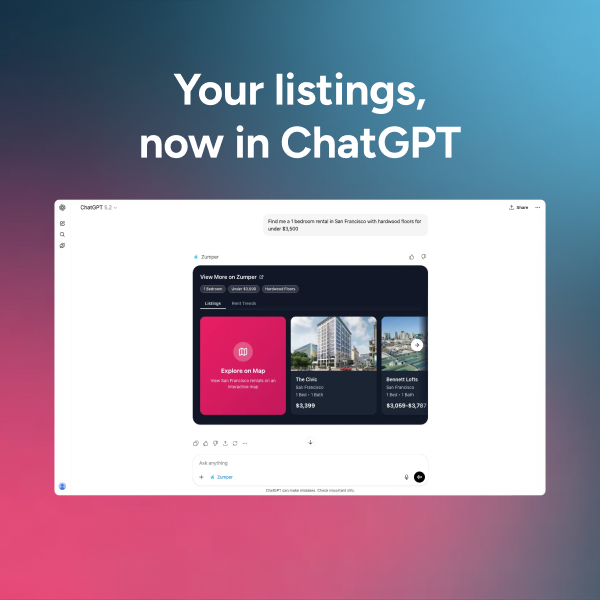

Once you have your property ready to go and you understand how to become a landlord, you’re ready to post a listing for your property. Becoming a landlord takes some hard work, but it’s a great way to generate income over time.