You might be wondering, how much can I rent my property for? As a landlord or property manager, setting the rental amount can be tricky. You want to ensure that the price is low enough to attract applicants, while high enough to cover costs. Higher prices can lead to longer vacancies, but lower prices might result in too little income for your needs. Determining the right rental amount for your unit, or units, can be a challenge.

Fortunately, there are a number of straightforward steps landlords can take to figure out how to properly price rentals. With these simple steps, outlined in detail below, you’ll have a better idea of the going rate in your local market and what you want to charge for rent:

- Review rental laws

- Check prices in your location

- Look at your amenities

- Research home values

- Ask about pets

- Consider demand

- Factor in your expenses

1. Review rental laws

Before you set a price, you should investigate the rent laws in your city and state. If your market has rent control laws, there are limits to how much you can charge each month and how much you can increase rent each year. Speak with an attorney to confirm whether your city or state has rent control laws and what the limitations are so you can determine a fair and legal rent price for your property.

2. Check out prices in your location

You’ve heard it before: Location, location, Location. One of the most important factors when it comes to housing, your property’s proximity to the city center, shopping, entertainment, and mass transit can have a huge effect on the rent you can charge. Many tenants want to be close to their school, work, food, and entertainment. If you are in a prime location, often tenants are willing to pay a premium to be close to the action. However, if your location is further out and requires a commute, you may find it harder to command a high rental rate.

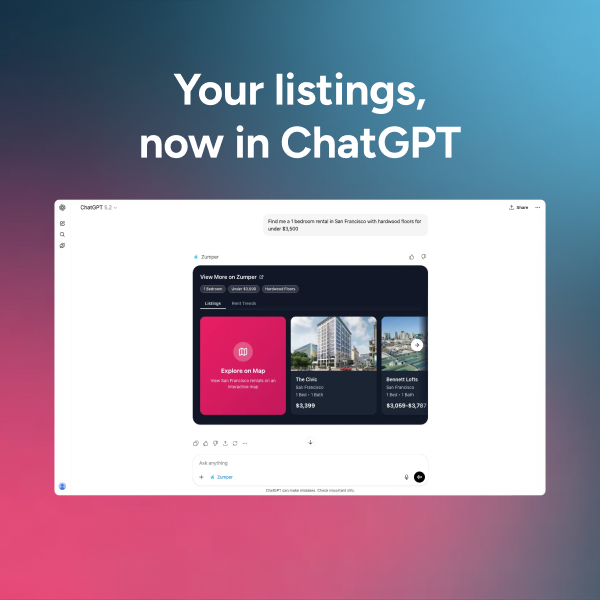

Even if you think you know the rents for your area, it’s always good to check out the other local listings. Use Zumper’s search tools to find similar listings nearby.

3. Look at your competitors’ amenities

Take a look at the amenities your property offers and compare it to those of other nearby listings. You should also look at the square footage and other features of competitive buildings. How does your rental stack up? If your property is considerably newer or has more amenities, it might be worth a premium. If the unit is awkwardly laid out, older, or has fewer amenities, it may need to be priced lower than the average.

For landlords wanting to raise rents, a smart investment in upgrades and renovations can give you room to increase the monthly rent. Tenants are looking for more amenities, such as a laundry room, playground, gym, or swimming pool. These amenities can increase the appeal of a rental and give you wiggle room to increase rent.

Some of the most popular amenities include:

- Outdoor space

- Storage

- Package service

- Pool

- Garage Parking

Other renovations to the rental unit itself, such as: upgraded flooring, granite countertops, new appliances, may be worth the increase in monthly income. With any renovations or upgrades, be mindful of the ROI. Do not pour money into a unit that cannot recoup that cost. Even if it’s the nicest rental in the area, you cannot reasonably charge much more than the next highest unit. When you outprice the market, you will find difficulty finding applicants.

4. Research home values and property worth

If you’re renting a single-family home or duplex, there may not be a plethora of other rentals to compare to nearby if your area is largely apartments. If this is the case for you, research recent home sales to see what buyers are paying for homes close by. Then use a mortgage calculator to get a ballpark figure of what the homeowner is paying for their mortgage each month. You can then charge roughly 1% of that estimated mortgage value as monthly rent.

This tip is a reverse-engineer of the standard investor advice to only buy a property that meets the 1% rule. If you can buy a home and rent it for 1% of the total value, give or take other factors, it is considered a sound investment. We use this rule in reverse to determine a rough figure for monthly rent on your unit.

5. Ask the pet question

A big factor in rentals is pets. Millions of renters own pets and look specifically for houses or apartments that will allow them to keep their pet. If you allow pets in your rental, this may give you a competitive edge over other units. This can allow you to increase rents while keeping a list of interested applicants. Some landlords choose to ask for an upfront pet deposit, or add an additional fee to the monthly rent. Online you can explore what other landlords are doing and choose how you will answer the pet question yourself.

Remember, if you allow one pet, you do not have to allow all pets. You may determine that your rental is a good fit for cats, but not for dogs. Or you may meet a potential tenant that has several large dogs. As the landlord, you can place rules (as legal) regarding pets.

6. Consider seasonality and demand

Another factor to consider is the demand for apartments like yours, and seasonality. In many locations, summer is a more popular time to move, and apartments are more in demand and go faster. In winter, you might have fewer prospective tenants, which can make it more difficult to find new tenants. When there’s higher demand, whether because of seasonality or other factors like location, you can charge a bit more. When demand is lower, you might consider lowering rent prices a bit to attract more applicants.

7. Factor in your expenses

When determining rental prices, you need to factor in your own expenses. Will your rental income cover your mortgage, property taxes, home insurance, and maintenance costs? Are you hiring a property management company? Or will you be losing money each month? It is better to rent smart than to rent quickly.

Using your expenses as your baseline, calculate the minimum rent payment you’d need to receive each month to cover costs. Then, calculate the highest you can charge based on the other factors we’ve outlined—rent laws, location, amenities, property worth, and demand—along with what helps you build cash flow. Your ideal rental price is between these two numbers: a price within the scope of your market that covers expenses, but isn’t so high that you only receive a small number of renter applications.

Determining rental prices is always a balance. Striking the balance between a price that is low enough to encourage applicants while high enough to ensure you cover costs is crucial to your success as a landlord. Using these straightforward steps, you can figure out the right price for your unit.